Loan calculator with cost of borrowing

To Use the online Loan Calculator 1 simply. If you want a home improvements loan you can repay it over an extended period of up to 10 years.

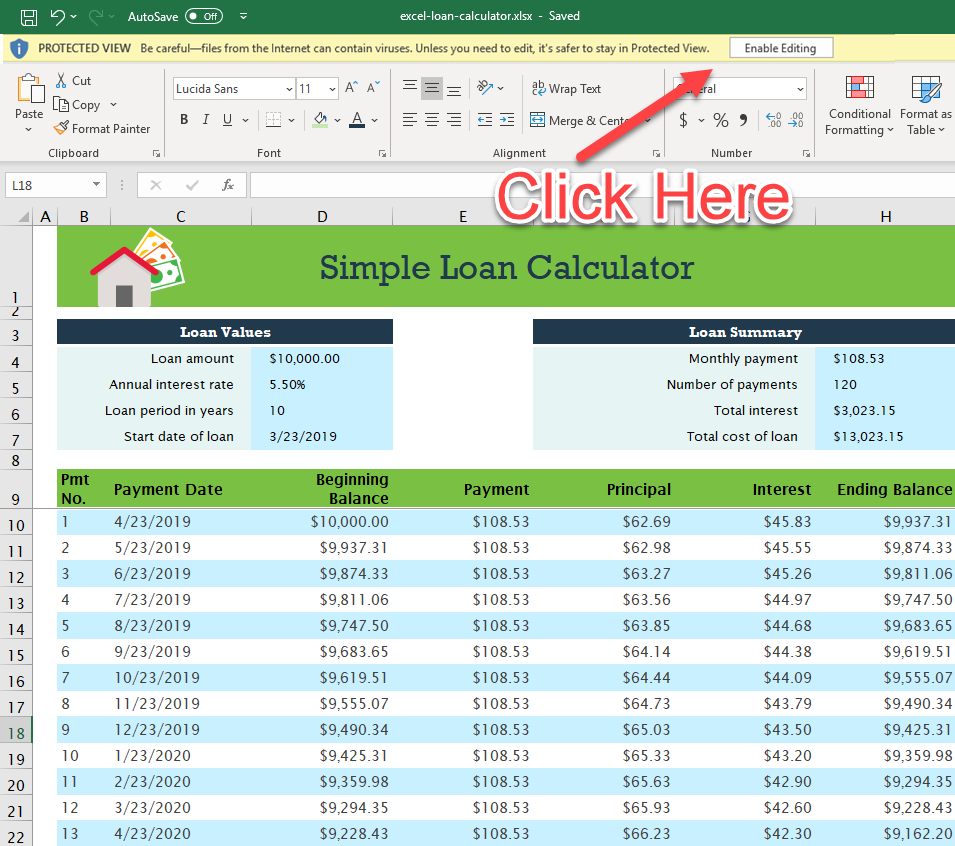

Simple Loan Calculator

If you want to get out of debt faster shorten your loan term to see how much youd need to pay each month.

. Our Loan Calculator is a free calculation online tool you can use to calculate your monthly payments and loan interest costs for different kind of loans like personal loans auto loans etc. He still owes a few thousand dollars on the loan and has to make car and student-loan payments. The loan calculator on this page is a simple interest loan calculator.

Results from the ING Personal Loan Borrowing Power calculator do not constitute an application or offer of credit and do not imply that credit is available. The comparison tables below display some of the variable rate home loan products on Canstars database with links to lenders websites for borrowers in NSW making principal and interest repayments on a. Dan Behar took out a 7000 personal loan from American Express about two years ago to help pay for a move from Long Island to Brooklyn.

The annual MIP varies based on the loan term loan amount and loan-to-value LTV ratio. 2022 FHA Annual MIP Rates. Our borrowing power calculator gives you an initial estimate of what a lender may be willing to lend to you.

Find out how much you need to budget for the car you love. He gets roughly one offer a day in his mailbox from lenders encouraging him to borrow more. This amount may not be the final amount you need to re finance your property and is used solely for the purpose of providing you with an indication of the loan amount you may require the upfront costs you may incur.

Because the term of the loan is used in the calculation break costs tend to be very high for 10-year and 15-year fixed-rate terms as well as for large loan amounts. If youre looking to take out a personal loan but arent sure how much you can afford to borrow this personal loan calculator can help you find the answer. Use the tables below to figure out proper MIP rates.

About home loan specialists. This is a handy step to take before you contact your mortgage broker so that you can see the effect different interest rates and loan periods will have on the amount of money you can borrow the total interest you pay and your estimated. Our borrowing power calculator asks you to enter details including your loan term and interest rate income and expenses and any outstanding.

If rates have increased since you fixed your loan theres a good chance that you wont be charged. You will need to. Your student loan repayment term.

The information provided on this website is for general education. By using this calculator youll discover exactly how your loan balance interest rate and repayment term impact your long-term costs of borrowing. Compare home loans on Canstars database.

Federal loans generally have a standard repayment schedule of 10 years. Loan limits are higher in areas with high-cost real estate and borrowers purchasing 2-4-unit properties can often get a larger loan amount than those buying single-family homes. The interest rate represents the cost of borrowing money.

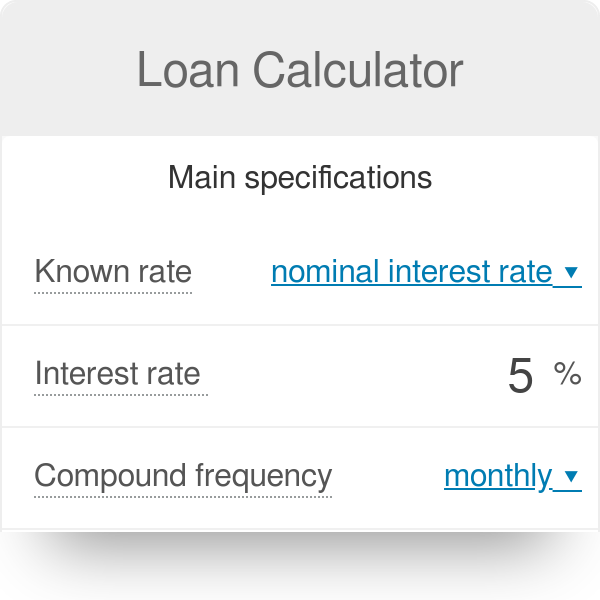

You can find various types of loan calculators online including ones for mortgages or other specific types of debt. Input the Annual interest rate for the loan. Youll be given a definite term for your loan when you apply.

Are not included in the comparison rate but may influence the cost of the loan. Your loan repayment term is the number of years you have to pay it back. Our loan terms vary from 2 to 8 years.

You can choose to repay your loan over 2 to 8 years. If you want a home improvements loan you can repay it over an extended period of up to 10 years. Open an ING Personal Loan.

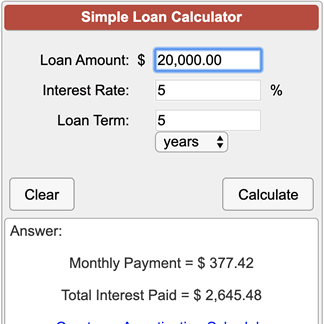

To calculate the payment amount and the total interest of any fixed term loan simply fill in the 3 left-hand cells of the first row and then click on Compute. Loan Calculator - Canadian Loan Calculator. Get an idea of how much a 401k loan might cost in monthly payments by using this calculator.

Use the personal loan calculator to find out your monthly payment and total cost of borrowing. Be aged 18 and be able to provide us with your ID. On the other hand APR is a broader measure of the cost of a loan which rolls in other costs such as broker fees discount points closing costs and administrative fees.

2 For private student loans the repayment term can range anywhere from 5-20 years depending on the loan. If you borrow 900000 against a property valued at 1000000 then what would your LVR be. 909 APR Estimate based on your credit rating.

Type into the personal loan calculator the Loan Amount you wish to borrow. By definition the interest rate is simply the cost of borrowing the principal loan amount. Use our loan calculator to compare different term times to see how it affects the total cost of the loan.

The upfront MIP is the same for all which is 175 of the loan amounts and can be financed directly into the mortgage loans. Use our Student Loan Payment Calculator to view your estimated student loan payment and total cost on an undergraduate MEFA LoanSimply input the amount you plan to borrow the estimated strength of your credit profile you can learn more about your credit here and the number of years before your child graduates eg. Example of how to calculate LVR.

Loan TermLonger than 15 Years. As you can see the difference between the cost of borrowing the loan with a 76 and 119 APR is significant. A loan calculator is an automated tool that helps you understand what monthly loan payments and the total cost of a loan might look like.

Youd save 36259 in interest over the life of your loan by. How much can I borrow. Use our loan calculator to compare different term times to see how it affects the total cost of the loan.

If you choose to spread your loan over a longer period your monthly repayments will be. 4 years for incoming freshmen 3 years for. Break fee Loan amount x Remaining fixed-term x Change in cost of funds.

Your income expenses and deposit are the biggest factors determining your borrowing power but lenders also consider other factors such as your existing debts and if you are using a guarantor for the loan. This calculator will calculate the monthly payment and interest costs for up to 3 loans -- all on one screen -- for comparison purposes. For example if you want to get a 10000 personal loan from Royal Bank of.

The loan amount has been calculated based on the information input by you and information sourced by third parties. Borrowing money from your 401k plan can be a way to get a low-interest loan but it comes at the risk of your savings and potential tax penalties. If you choose to spread your loan over a longer period your monthly repayments will be lower.

1000000 This would be considered high-risk LVR by the lender so they would require LMI for your loan.

Loan Calculator That Creates Date Accurate Payment Schedules

Loan Calculator

Pin On Business News

Loan Calculator Credit Karma

Here S A Quick Guide To Knowing The Magic Of Compound Interest In 2022 Compound Interest Simple Interest Loan Calculator

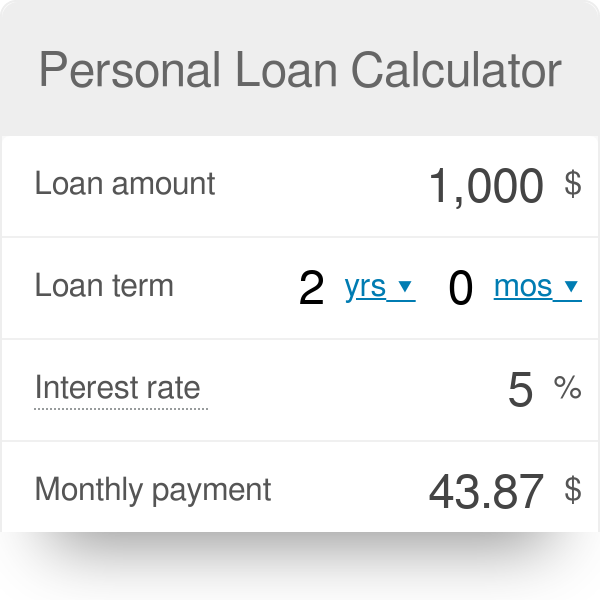

Personal Loan Calculator

How To Dodge Mortgage Insurance Fees When Applying For A Home Loan Infographic Mortgage Payment Calculator Home Mortgage Mortgage Payment

Mortgage Calculator Google Search S New Mortgage Calculator Can Help You Plan Beyon Mortgage Payment Calculator Mortgage Amortization Mortgage Calculator Tools

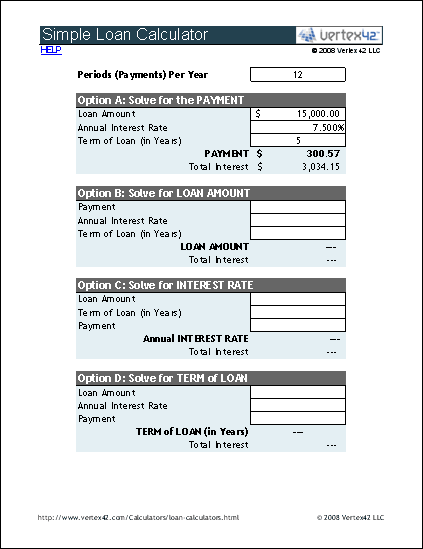

Loan Calculator Free Simple Loan Calculator For Excel

Downloadable Free Mortgage Calculator Tool

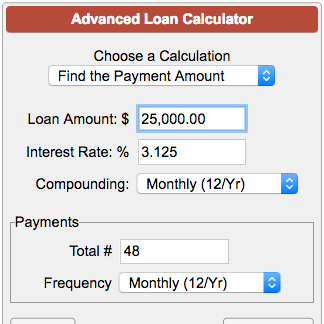

Advanced Loan Calculator

Loan Repayment Calculator Personal Loans Mortgages Repayments Disabled World

Loan Calculator That Creates Date Accurate Payment Schedules

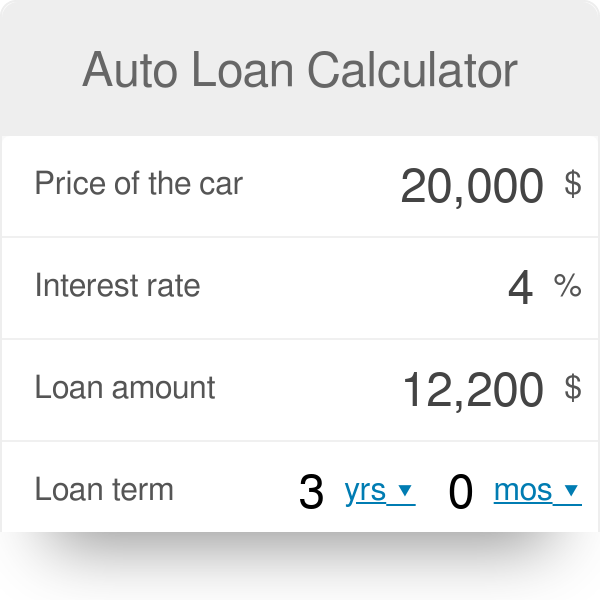

Auto Loan Calculator

Excel Formula Calculate Payment For A Loan Exceljet

Download Microsoft Excel Simple Loan Calculator Spreadsheet Xlsx Excel Basic Loan Amortization Schedule Template

Best Personal Loans For Good Credit Bad Credit In 2018